Self Storage Trends and Statistics: 2025 Updated Report

Find the latest self-storage statistics and trends driving the industry. Get important insights into the current state of the industry and future projections.

Self storage has experienced fascinating market trends in the 21st century, with businesses in this sector attracting increased customer attention. In fact, the self storage industry in the US alone generated over $39 billion in revenue in 2023, showcasing its rapid growth and significance. With the increasing demand for space, self storage has become one of the most viable solutions for people looking to declutter their homes or store goods for their e-commerce businesses.

Despite the growth, public awareness of self storage services remains relatively low, with only 43% of the population familiar with the concept and just 8.7% actively considering its use. Nonetheless, those who do use self storage report high levels of satisfaction, even though 39% of customers perceive the cost as high. This highlights an opportunity for facility owners to enhance their outreach efforts and address pricing perceptions to attract a broader customer base.

Let’s examine some eye-popping self storage statistics and trends in this 2024 Self Storage Market Report to see how big the industry has become and where experts think it’ll go next.

The self-storage industry has shown consistent revenue growth over time, averaging an 8% increase. As of the most recent count, there are 52,301 self-storage facilities across the United States. The rate of new facilities opening has also accelerated; from 2010 to 2019, an average of 439 new facilities opened annually, while 2020 to 2023 saw this figure jump to 735 new facilities per year. Occupancy rates have varied slightly in recent years as shown in the below graph

Insight: The steady growth in revenue and occupancy rates highlights the increasing reliance on self storage solutions. With more facilities opening each year and a diverse customer base, the industry is poised for continued expansion.

Updated 10/30/2024 This page presents the latest statistics on the self storage industry, compiled by Storeganise. We continuously update this page as new data becomes available. If you have data to contribute or any questions regarding the information here, please email us at editor@storeganise.com.

In this report:

- The Self Storage Industry Continues to Grow at Record Pace

- 8 Important Self Storage Industry Trends for 2024 and Beyond

- Increased Adoption of Self Storage Websites

- More Efficient Budgeting via Self Storage Software

- Heightened Data Security to Protect Customer Data

- Increased Use of Cloud Storage Services

- Online Leasing for Self Storage Facility Searchers

- Adoption of Sustainable Practices

- Enhanced Customer Convenience

- An Increase In Investment Trends - Self Storage Construction Boom Shows No Signs of Slowing Down

- Statistics on Self Storage Inventory by Region in the US

- Self Storage Industry Statistics by Region in the UK - Self Storage Is Becoming More Popular With Millennial Renters

- Average Self Storage Rental Rates Hit New Highs

- Statistics on the Average Monthly Storage Rent Prices in the US

- Statistics on the Average Monthly Storage Rent Prices in the UK - Frequently Asked Questions

- Is storage space in demand?

- Is self storage a good business in the UK?

- What are the new trends for storage?

- What is the size of the self storage industry?

- How many self storage facilities are there in the US?

- What is the outlook for the storage industry? - Conclusion

The Self Storage Industry Continues to Grow at Record Pace

US

The self storage industry shows no signs of slowing down. In fact, the latest statistics show unprecedented growth that is projected to continue for years to come. In the US alone, the self storage market size is currently valued at $44.33 billion and is expected to hit $50.01 billion in 2029, growing at a CAGR of 2.44%.

Europe

Similarly, Europe’s self storage market is thriving, boasting 9,575 facilities that cover a total of 16.5 million square meters of space. The UK leads the charge with a 34.6% market share, followed by France at 15.8%, Germany at 12.6%, and Spain at 11.6%. This regional distribution underscores the diverse demand across Europe and the potential for further growth in underrepresented areas.

Global

On a global scale, the self storage business is set to grow at an even faster pace of 4.15%. Valued at $64.14 billion in 2023, projections indicate the market will amount to $85.27 billion by 2030. Driving this expansion is the ever-increasing demand for extra space. As populations rise and living spaces shrink, people are accumulating more belongings than they have room for at home.

For those looking to capitalize on this booming industry, now is the time to act. Whether you’re considering investing in a new facility, expanding an existing one, or simply exploring the market, the potential for significant returns is substantial. Read on for some interesting self storage trends defining the future of this essential industry.

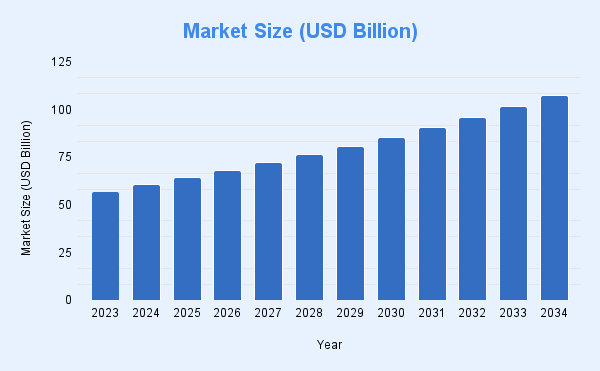

The self-storage market is projected to experience a steady Compound Annual Growth Rate (CAGR) of 5.91% from 2024 to 2034. Starting with a market size of $60.41 billion in 2024, the industry is set to expand significantly over the next decade, reflecting its growing importance and demand across various sectors.

Source: Precedence Research

Insight: The notable growth rate highlights the increasing demand for self storage solutions. Investors and business owners should consider the rising need for storage space as a key driver for future investments.

So, what are some of the trends allowing self storage facilities to cater to this increasing demand?

Download the ultimate Self Storage e-book

Everything you need to know about setting up your self-storage facility.

8 Important Self Storage Industry Trends for 2024 and Beyond

The below trends (both current and emerging) are shaping the future of the self storage industry in 2024 and beyond:- Increased adoption of self storage websites

- More efficient budgeting via self storage software

- Heightened data security to protect customer data

- Increased use of cloud storage services

- Online leasing for self storage facility searchers

- Adoption of sustainable practices

- Enhanced customer convenience

- An increase in investment trends

1. Increased Adoption of Self Storage Websites

In today’s modern world, virtually all activities occur online. As a result, creating a website and establishing a presence on social media is essential to any business’s modern success. In fact, a recent survey by Forbes Adviser reveals that 83.5% of small businesses with a website report that these platforms have made their business more efficient and accessible to customers.

Retail giants like Walmart and Amazon aren’t the only ones competing in the digital sphere. Self storage facility owners are increasingly adopting websites for their business to accommodate consumer trends and meet the increasing demand driven by increased urbanization and the need for additional storage space.

Any investor looking to build or invest in a self storage facility today should consider creating a reliable and speedy website. A well-designed website can help address various issues and attract new customers as the future of the self storage market leans towards increased technology adoption.

Recognizing the importance of digital presence, we’ve recently added the ability to create and edit your website directly from the Storeganise dashboard. This feature enables you to effortlessly manage your online presence, ensuring that your business stays competitive in this rapidly growing market.

2. More Efficient Budgeting via Self Storage Software

The days of the merchant sitting at a desk with a calculator and a drawer partitioned to hold different currency denominations are long gone. In today’s fast-paced world, self storage companies are adapting well to dealing with various costs. With more self storage businesses now using specialized software for budgeting and financial management, digital solutions have become the norm. A self storage software like Storeganise allows you to compute billing and accounting tasks with ease, helping you manage costs, taxes, and profits efficiently.

If you plan to join this trend, look for software with integrated payment processing, real-time reporting, and automated reminders. These features are key for streamlining operations and enhancing customer satisfaction. Also, opt for software that scales as your business grows and evolves.

3. Heightened Data Security to Protect Customer Data

In the fast-paced world of self storage, keeping track of consumer data and finances can be a daunting task. It’s all too easy to misplace paper records or lose track of electronic data within spreadsheets. This is why robust security protocols are crucial to safeguarding sensitive information.

As your self storage business expands, managing new expenses, fluctuating market prices, tax obligations, utility bills, and payments from both new and overdue accounts can become increasingly complex. Recent self storage industry statistics reveal a growing trend: more self storage businesses are utilizing advanced data management software to streamline their operations and protect customer data.

Today, the industry is rapidly adopting AI-driven monitoring systems and implementing tighter ID checks to bolster security. Digital locks and biometric identification are becoming the norm, reducing reliance on physical keys and enhancing access control. A diverse range of data management software is available that not only shields your data from viruses and unauthorized access but also keeps track of overdue payments. By automating calculations, these tools virtually eliminate human errors, ensuring your information remains intact and secure.

For self storage operators, embracing these technological advancements is not just beneficial; it’s becoming essential. By adopting these innovative solutions, you can maintain order and security in your consumer data, allowing you to focus on what truly matters—growing your business.

4. Increased Use of Cloud Storage Services

The self storage industry’s shift to cloud technology is remarkable; facilities are increasingly seeking secure and more reliable ways to manage databases. With cloud services, self storage owners can control their storage units from any location on Earth, allowing for convenient data retrieval.

Cloud storage services are also cost-effective, preventing costly database crashes and restoration. What’s more, database failures are rare due to cloud services’ built-in repair systems.

5. Online Leasing for Self Storage Facility Searchers

Despite various marketing techniques, the time from initial inquiry to a signed lease can vary widely. However, most of the work in selecting a self storage facility can now be done online. According to self storage industry statistics, in 2024, many self storage businesses are adopting online leasing to streamline this process.

To fully exploit this trend, ensure your website provides everything needed for a positive customer experience. Enhance the booking process by using reliable self storage software that automates billing and sends invoice reminders on time.

6. Adoption of Sustainable Practices

Sustainability is fast becoming a cornerstone of the self storage industry, with 73% of operators recognizing its importance. Common initiatives include installing LED lighting, using recyclable packaging materials, installing climate control systems, and providing EV charging stations.About 58% of investors are willing to pay a premium for properties equipped with renewable energy sources, underscoring the financial and environmental benefits of sustainable practices. By adopting these practices, the industry is reducing its carbon footprint and attracting environmentally conscious customers.

7. Enhanced Customer Convenience

Self storage facilities are enhancing customer convenience through various initiatives. User-friendly websites and online platforms now allow customers to book and manage storage units easily. Many facilities also offer contactless access options, enabling customers to enter the premises and access their belongings without physical interaction. These conveniences improve the overall customer experience and cater to evolving needs and preferences.8. Increased Investment and Deals

Investment in the self storage sector is on the rise. In 2024, €875 million in transactions was recorded in Europe, a figure that has tripled compared to the previous year. Key deals include strategic acquisitions by major players like Shurgard and a growing focus on long-term “evergreen” funds dedicated to self storage properties, reflecting investor confidence in the sector's robust future.It’s clear that the self storage industry is growing rapidly from year to year, and facility owners are adopting these trends to keep up with the increasing demand. But just how fast is this expansion happening in different regions of the world?

Self Storage Construction Boom Shows No Signs of Slowing Down

Over the last five years, 278.8 million square feet of storage space has been built in the US, equivalent to 14.3% of the total inventory.

Self storage industry statistics in Canada and the US indicate that developers and owners are finding ways to fund construction, with deliveries hovering around 60 million square feet on a trailing 4-quarter basis. New supply is being absorbed at a healthy pace, keeping vacancy rates stable and supporting gradual growth in rental rates.

The following self storage inventory statistics for the US and the UK support these trends.

Statistics on Self Storage Inventory by Region in the US

The US regional storage unit demand continues to see steady growth, though at a slightly slower pace than in previous years, as indicated by the following figures:

- Self storage inventory grew by 1.8% in 2023, adding 25.6 million net rentable square feet.

- The South added the most recent space, 9.8 million net rentable square feet, followed closely by the West, 8.9 million.

- The Midwest and Northeast lagged, adding 4.0 million and 2.9 million square feet, respectively.

| Area | 2022 Increase in Inventory (Sq. Ft.) |

|---|---|

| South | 9.8 million net rentable square feet |

| West | 8.9 million net rentable square feet |

| Midwest | 4.0 million net rentable square feet |

| North East | 2.9 million net rentable square feet |

| Total | 25.6 million net rentable square feet |

These regional differences in growth align with broader economic and population trends in the US. Employment rates and population are increasing more rapidly in Southern and Western states. At the same time, more affordable cost of living and business-friendly policies are attracting new residents and businesses to these areas.

Self Storage Industry Statistics by Region in the UK

Statistically, the South East and North West regions are projected to lead inventory growth, increasing 6.3% and 4.9%, respectively.| Region | Increase in Inventory (Sq. Ft.) | Growth Rate |

|---|---|---|

| South East | 570 million | 6.3% |

| North West | 310 million | 4.9% |

| West Midlands | 260 million | 3.2% |

| East Midlands | 220 million | 2.8% |

| South West | 190 million | 2.1% |

| Yorkshire and The Humber | 170 million | 1.9% |

| East | 160 million | 1.6% |

| London | 140 million | 1.2% |

| North East | 120 million | 0.9% |

| Scotland | 90 million | 0.7% |

| Wales | 70 million | 0.5% |

| Northern Ireland | 50 million | 0.3% |

The population and business growth in the top regions explains why they’re poised for the most inventory growth. As a self storage business owner, you should consider expansion into high-growth areas to take advantage of increased demand. It’s equally important to monitor lagging regions in case inventory growth rises to match demand.

However, the European market needs more marketing efforts to reach a broader audience. Awareness of self storage services varies across Europe, with 37% of people unfamiliar with the concept, particularly outside capital cities. On the contrary, markets like Denmark and Ireland exhibit higher awareness and intention to use these services, driven by tight residential markets that necessitate additional storage solutions. This indicates a need for increased marketing efforts in less aware regions to capture untapped potential.

In addition to regional considerations, investors should consider targeting millennials — self storage trends indicate this age group comprises the leading renters of outdoor space. Read on to learn more.

Self Storage Is Becoming More Popular With Millennial Renters

Self storage facilities are seeing a surge in millennial renters. Nearly 1/3 of all self storage renters today are millennials, up from just 20% a few years ago. This trend shows no signs of slowing down, as observed in the following self storage statistics:

- In the United States, millennials account for around 40% of all self storage users.

- In the UK, young consumers represent a growing segment of self storage users, with an estimated 54.4% utilizing storage facilities.

- The average length of rental for millennials in the United States is approximately 10 months.

- In the UK, millennials rent self storage units for an average of 8 months.

- 45% of millennials rent self storage due to downsizing or decluttering.

- 30% of millennials rent self storage due to a lack of space in current living arrangements.

- 15% of millennials rent self storage for temporary storage during a move.

- 5% of millennials rent self storage to store seasonal items.

- 3% of millennials rent self storage to store belongings while traveling or studying abroad.

- 2% of millennials rent self storage due to store hobby or recreational equipment.

- The average unit size millennials rent in the United States is around 100 square feet.

- In the UK, millennials typically rent units rangsystem to keep this informationing from 25 to 50 square feet.

- In the United States, the average monthly cost of renting a self storage unit for millennials is approximately $90.

- In the UK, the average monthly cost for millennials ranges from £25 to £100, depending on location and unit size.

High demand also means high prices, especially where supply is lower. The self storage industry has experienced a new high in rental rates, and the following figures throw more light on this.

Average Self Storage Rental Rates Hit New Highs

The self storage industry is booming, with no signs of slowing down. Recent surveys and reports reveal that average rental costs for storage units in the US and UK have soared to unprecedented levels, with projections indicating further rises. For example, in the UK, 68% of self storage facility owners expect existing customer rates to rise above inflation.Here are some self storage statistics on average rent prices:

Statistics on the Average Monthly Storage Rent Prices in the US

The average price for renting a self storage unit in the US continues to increase, supported by the following figures:

- Rental rates have risen by 4% since 2021 and are expected to continue rising. Specific regions and cities may see even higher spikes. For example, the West Coast continues to have the country’s highest rates.

- Major cities like Los Angeles, San Francisco, and Seattle experienced average rate hikes of around 7–10% in 2022. With demand still rising in these areas, 2024 is expected to bring another sizable increase.

- Conversely, some Southern and Midwestern cities have remained more affordable. Rates in cities like Houston, Dallas, Chicago, and Atlanta grew slower, around 2–4% in 2022. While modest upticks are anticipated again this year, these cities will likely still offer lower prices than coastal hubs.

- Depending on location and amenities, you should expect to rent the average 5x5 storage unit for $60 to $200 monthly in 2023. Climate-controlled units, 24-hour access, and high-security features can command $20–50 more monthly. Smaller towns and rural areas will remain on the lower end of the spectrum.

Statistics on the Average Monthly Storage Rent Prices in the UK

If you’re considering renting a self storage unit in the UK, here are the average monthly rental rates across different regions of the country in 2024:

| Region | Rate |

|---|---|

| London | £38.80 per square foot annually |

| SouthEast | £23.50 per square foot annually |

| East England | £26.47 per square foot annually |

| South West | £21.00 per square foot annually |

| North West | £18.90 per square foot annually |

| West Midlands | £20.34 per square foot annually |

| Yorkshire and The Humber | £19.00 per square foot annually |

| East Midlands | £20.82 per square foot annually |

| North East | £19.70 per square foot annually |

| Scotland and Wales | £20.34 per square foot annually |

If you’re considering renting a self storage unit in the UK, here are the average monthly rental rates across different regions of the country in 2024:Depending on the size and location of the facility, London’s self storage rent prices are usually higher than those in other regions. In 2024, the average monthly rent for a self storage unit in London ranged from £100 to £300 compared to £25 to £90 in the North East. In many areas, available land is becoming scarce and expensive. This cost is passed onto customers in the form of higher rental rates, but higher rental rates often run the risk of triggering lower occupancy.

While European occupancy rates have slightly declined from 79.9% to 78.7%, rental returns have seen a 2% increase, averaging £296.53 per square meter annually. This suggests that while fewer units are occupied, the value of rental agreements has risen, indicative of a strong market where quality and pricing strategies are effectively leveraged to maintain revenue streams.

Investing in regions with lower initial costs, like the North East, can offer a competitive edge, especially if you invest in automation tools like self storage software. Despite economic challenges, such as inflation, 72% of self storage operators anticipate profit growth in the coming years, with Germany showing the highest optimism. While economic pressures persist, oversupply is not currently viewed as a significant risk, highlighting the industry’s robust demand and strategic management practices that continue to drive profitability.

Frequently Asked Questions

Is storage space in demand?

Yes, storage space is in high demand, and it’s expected that the self storage industry will grow in size and demand as the years roll by. The growing global self storage market exemplifies this — valued at $54 billion in 2021, and it’s expected to hit $83.6 billion in 2027, growing at a CAGR of 7.53% within the 2022–2027 forecast period.Vacancy rates are decreasing month to month as this major market experiences a demand pull. Advancements in storage units, such as climate-controlled units, drive-up storage and vehicle storage, are also more popular.

Is self storage a good business in the UK?

Yes, self storage is a good business in the UK, with the industry representing one of the country’s most rapidly developing and lucrative sectors. Occupancy rates hit a record high of 83.3% in 2022, while average rental rates (ARR) spiked by 9% in the past year to hit £26.13 per square foot. Churn rates also went down from 118% recorded in pre-pandemic times to 76%, highlighting how recession-resistant the industry is.What are the new trends for storage?

The self storage industry has seen several new trends, with the following being the most prominent:- Increased adoption of self storage websites

- More efficient budgeting via self storage software

- Heightened data security to protect customer data

- Increased use of cloud storage services

- Online leasing for self storage facility searchers

- Adoption of sustainable practices

- Enhanced customer convenience

- Increased investment and deals

What is the size of the self storage industry?

The overall market size of the self storage industry was predicted to reach $58.26 billion in 2023 and grow at a CAGR of 7.5% to reach $89.94 billion by 2030. In the US alone, the industry accounts for more than 1.7 billion square feet of space.How many self storage facilities are there in the US?

There are currently over 50,000 storage facilities in the US. This translates into 6 feet of storage space per American.What is the outlook for the storage industry?

The outlook for the self storage industry remains positive, with forecasts to reach $72.15 billion by 2028. Despite some slowdown in growth due to increasing interest rates and other economic factors, the industry’s fundamentals are strong, and demand continues to be robust.Technology is also playing an increasing role in the industry, with more businesses adopting advanced technologies to improve their services and efficiency. That includes using mobile apps and self storage software solutions for easy access and management of storage units, automated kiosks for 24/7 customer service, and even AI and machine learning for predictive analytics and pricing strategies.

Conclusion

The self storage trends and statistics for 2024 and beyond promise continued growth. We’ll probably see more mega-operators buying up smaller facilities, more climate-controlled units for protecting valuables, and tech improvements like digital locks and inventory tracking. Rental rates may climb, too, if demand stays high.For investors looking for a sustainable investment, the self storage industry is a good place to start. Also, consider implementing reliable self storage software to help streamline operations and increase customer convenience.

References:

Frequently Asked Questions

Is Storage Space in Demand?

Yes, storage space is in high demand, and it’s expected that the self storage industry will grow in size and demand as the years roll by. The growing global self storage market exemplifies this — valued at $54 billion in 2021, and it’s expected to hit $83.6 billion in 2027, growing at a CAGR of 7.53% within the 2022–2027 forecast period.

Vacancy rates are decreasing month to month as this major market experiences a demand pull. Advancements in storage units, such as climate-controlled units, drive-up storage and vehicle storage, are also more popular.

Is self storage a good business in the UK?

Yes, self storage is a good business in the UK, with the industry representing one of the country’s most rapidly developing and lucrative sectors. Occupancy rates hit a record high of 83.3% in 2022, while average rental rates (ARR) spiked by 9% in the past year to hit £26.13 per square foot. Churn rates also went down from 118% recorded in pre-pandemic times to 76%, highlighting how recession-resistant the industry is.

What are the new trends for storage?

The self storage industry has seen several new trends, with the following being the most prominent:

- Increased adoption of self storage websites

- More efficient budgeting via self storage software

- Heightened data security to protect customer data

- Increased use of cloud storage services

- Online leasing for self storage facility searchers

- Adoption of sustainable practices

- Enhanced customer convenience

- Increased investment and deals

What is the size of the self storage industry?

The overall market size of the self storage industry was predicted to reach $58.26 billion in 2023 and grow at a CAGR of 7.5% to reach $89.94 billion by 2030. In the US alone, the industry accounts for more than 1.7 billion square feet of space.

How many self storage facilities are there in the US?

There are currently over 50,000 storage facilities in the US. This translates into 6 feet of storage space per American.

What is the outlook for the storage industry?

The outlook for the self storage industry remains positive, with forecasts to reach $72.15 billion by 2028. Despite some slowdown in growth due to increasing interest rates and other economic factors, the industry’s fundamentals are strong, and demand continues to be robust.

Technology is also playing an increasing role in the industry, with more businesses adopting advanced technologies to improve their services and efficiency. That includes using mobile apps and self storage software solutions for easy access and management of storage units, automated kiosks for 24/7 customer service, and even AI and machine learning for predictive analytics and pricing strategies.