Investing in Self Storage: Complete Beginners Guide for 2026

Wondering how to invest in self storage? You are not alone. Many people see it as a viable investment opportunity in 2026 and look for tips for setting up a self storage facility.

Self storage is on an upward trajectory, with 4,536 properties in development and ever-growing demand. It is a viable investment option for portfolio diversification and a steady passive income source. However, many people do not know how to invest in self storage to get a high ROI.

This industry and asset class differs from other investment options depending on stability, risk, and cash flow. So, you must know how to invest in self storage to reap the benefits of this lucrative investment opportunity.

We have compiled all the necessary information in this guide to make investing in storage units easier for beginners.

Download the ultimate Self Storage e-book

Everything you need to know about setting up your self-storage facility.

Download for FREESelf Storage Market Overview (2026)

The global self-storage market is expected to reach over USD 105 billion by 2034, expanding from approximately USD 62.87 billion in 2026 at a CAGR of roughly 5.95%. (Toward Packaging/Precedence Researc)

North America leads the industry, accounting for nearly half of all revenue. (Precedence Research) In the United States alone, there are over 69,000 storage facilities and total rentable space exceeding 2.6 billion square feet.

Key factors driving growth include rapid urbanization, the rise of small-business inventory needs, higher rates of relocation, and expansion of e-commerce (see trend-analysis by Storeganise).

In Europe and Asia-Pacific, growing urban density and the search for cost-effective storage solutions are accelerating development in both mature and emerging markets. (Zion Market Research) Occupancy rates in major metro areas remain high, while secondary markets and suburbs are seeing targeted growth as operators seek underserved populations and adapt to shifting consumer behaviour. These trends highlight the continued relevance and dynamic nature of self-storage as both an investment and operational sector in 2026.

What is Self Storage Investment?

Self storage investment is a form of real estate investment where you invest your funds in self storage facilities and earn a return by rental income from the storage units. Your customers can be individuals or small and medium-sized businesses.

You can become an active investor by operating and managing the facility or a passive investor with no participation in business operations.

Some renters may rent the storage unit for a short period, while others need storage space for the long term. Either way, you earn rental income as long as the tenant keeps their belongings in the storage unit.

Paul Moore, from Wellings Capital, gave his advice after speaking to thousands of prospective self-storage investors and operators about this topic:

"There are at least seven unique paths to invest in self-storage. Here is a summarized list:

- Stairstep from Small to Large.

- Capital-Raiser.

- Deal-Finder.

- Go Big.

- Get a Job.

- Hire a Coach or Mentor.

- Invest Passively."

Now that you know a little bit more about it, let’s discuss the benefits and how to invest in self storage in detail.

Capital Requirements and Entry Barriers

Investing directly in a self-storage facility generally requires substantial capital outlay, with entry costs for down payments, construction, or acquisition often ranging from $100,000 for small facilities to over $1 million for larger developments (SpareFoot Investor Guide, Self Storage Investing). Financing options typically include SBA loans, commercial mortgages, or partnerships with investors (U.S. Small Business Administration, Inside Self Storage Finance Guide).

For those preferring passive investment, public REITs and syndicate opportunities allow market exposure with lower individual thresholds—sometimes as little as a few hundred dollars (Extra Space Storage Investor Relations, Public Storage REIT Overview, Streitwise Passive Real Estate Investing).

Successful investors should account not only for upfront costs but also for reserves for initial leasing phases, operating expenses, and periodic capital improvements (Marcus & Millichap Self-Storage Report 2026, Investopedia – Self Storage Investment Basics).

Self Storage as an Investment: What are the Benefits?

Experts view self storage investment as a flourishing business and a profitable investment opportunity.

Here are 6 reasons why investing in a self storage business is worth it.

-

Low risk

-

High demand

-

Stable income stream

-

Economic durability

-

Low maintenance

-

Flexible business model

1. Low Risk

Every business has some risks that can impact the return on your investment. You must invest in less risky options for a safer ROI. Self storage has low operational costs and, therefore, lower business and operating risks. Low operating costs mean you have high profit margins and can manage short-term revenue fluctuations better.

Furthermore, if a tenant breaks some rules or does not pay rental charges, you can mark a lien against their property. This means that in case of non-compliance by tenants, you may auction or sell their property to compensate for your dues.

Moreover, the demand for storage units is also not seasonal. You can always find tenants for your storage units if you’re in a good location and offer excellent customer service. All these factors lower the risk and make it a viable investment.

2. High Demand

Self storage businesses experience growing demand. From students to large and small businesses, everyone needs a storage unit. High demand for self storage means you can operate at capacity, taking more rental income. More rental income leads to high revenue and high profits, so you can get the best value for your investment.

Investors can diversify income streams from a storage unit by attractive add-ons like loading and unloading equipment or vending machines and increasing tenant capacity. This ensures a steady cash flow for the investors.

3. Stable Income Stream

One of the primary benefits of self storage investment is the potential for a stable income stream. Storage units for sale are in high demand, offering consistent rental income from tenants. Unlike other real estate investments that may experience fluctuations in occupancy rates, self storage units often maintain high occupancy levels due to the ongoing need for storage space.

4. Economic Durability

Self storage has proven to stay resilient during tough times, such as the 2008 financial crisis and the Covid-19 pandemic. It is unarguably one of the most thriving businesses in today’s world. The low operating costs and decent profit margins make it a remunerative business for investors.

The economic durability offered by this industry makes it an ideal investment for risk-averse investors and a passive source of income for portfolio diversification.

5. Low Maintenance

Self storage infrastructures are simple and easy to maintain. Once you build a storage facility, you do not usually need to spend frequently on improving or enhancing its infrastructure. All you need is a secure space with good lighting, a security system, and fire protection equipment.

If a self storage facility uses self storage management software, operations can be automated, reducing the need for on-site staff. These facilities reap the efficiency and cost benefits of automation. You can automate the following and several other functions with efficient management software.

- Profile management

- Billing and invoice management

- Storage unit booking

- Move-ins and move-outs

- Unit locks out on overdue payments

6. Flexible Business Model

The self storage business model is flexible to power through tough times. You can start a storage facility from an empty building and scale once you start earning enough profits. Besides self service kiosks, you may also add valet storage to increase the scope of your services and use management software to manage valet storage efficiently.

Many storage facilities offer a valet service; these are truck rental services as an add-on to help renters move their belongings. The flexibility of this business model helps investors get the best ROI in all economic situations. During the boom, you can focus more on seeking storage units for sale, whereas during a recession, there is high demand for rental units for downsizing.

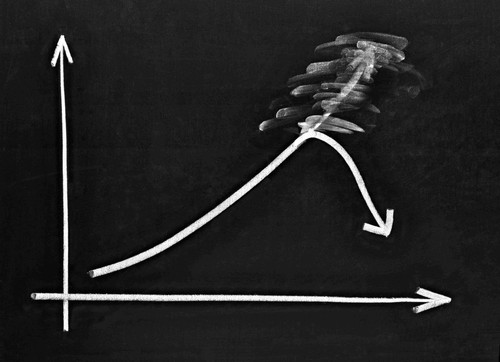

Risks of Investing in Self Storage

It’s important to understand that nothing is ever completely risk-free. You must know about the key self storage investment risks to mitigate them effectively.

Here are 3 common risks that you may face when investing in this industry:

-

Tricky market positioning

-

The need for active management

-

Risk of oversupply

1. Tricky Market Positioning

Although self storage is a lucrative business, you can only leverage its pros if you position your business right. Finding the right market for your storage facility and securing a place in the market is tricky.

The following factors make market positioning a challenge.

- Locating competitors

- Understanding customer demands

- Building the right mix of units

- Offering the amenities that renters want

- Finding an ideal real estate space in a busy location

If you do not analyse all these factors thoroughly and execute the right market positioning strategy, you may not get the desired results from the storage facility.

2. Need for Active Management

Unlike the common assumption, self storage management is not completely hands-off. Even if you install the latest self storage management software and automate most functions, as mentioned previously, you still need active management to oversee some business operations.

Ensuring that the security systems, management software, and other utilities are upgraded timely is vital. You need a comprehensive business plan and an expert team to execute the plan.

3. Risk of Oversupply

As storage facilities are easy to build and maintain, more investors are attracted towards self storage investing. This creates the potential risk of oversupplying storage facilities. This can intensify the competition and reduce the potential demand for your particular storage facility:

The 3 Self Storage Classes

Before researching how to invest in self storage, you must know the different classes self storage is classified into.

Here are 3 classes representing different self storage groups

-

Class A: A class includes self storage facilities that have been newly built in the last 10-15 years. These facilities are in ideal locations with all the modern amenities, such as climate-controlled storage units, modern storage management software, and advanced security systems. Due to these amenities, such storage facilities have low turnover and high occupancy rates.

-

Class B: Storage facilities more than 15 years old are classified into B class. These facilities offer amenities and maintenance but are not as good as A-class facilities. They may lack round-the-clock maintenance and climate-smart features. The rental charges of such storage units are also average.

-

Class C: Older storage facilities that are not found in a prime location are known as C-class storage. They have low rental charges with limited amenities. The security measures may also not be up to the mark.

As an investor, you must consider the features and amenities offered by each facility class to make your investment decision.

How to Invest in Self Storage Businesses? (4 Popular Ways)

If you wish to invest in the self storage market, here are four popular ways to do so. You can analyse each one of them closely to decide which one to choose.

-

Invest in Real Estate Investment Trusts (REIT)

-

Buy a self storage facility

-

Build a self storage facility

-

Invest in a self storage syndicate

1. Invest in Real Estate Investment Trusts (REIT)

One excellent means of getting into the self storage industry is to invest in real estate investment trusts, commonly known as REITs. Self storage REITs own and manage self storage facilities and earn profits by renting storage spaces to individuals and businesses.

They are one of the best investments in self storage in terms of performance and return. You can start investing in REITs with low capital and become a passive investor.

Select a well-performing self storage REIT with good profitability projections and invest in it. You can earn a return the same way you would earn through stocks.

Self storage REITs earn income through multiple sources. This includes rental income, management fees, reinsurance income, and overdue fines.

Pros of Investing in Self Storage REITs

- Rising demand benefits REIT investors.

- High-profit margins and ROIs.

- The passive investment makes self storage operations hands-off for you.

- You can get started with a small capital investment.

Risks of Investing in Self Storage REITs

- The risk of oversupply and high competition exists.

- As a passive investor, you have no control over business operations.

As a result, you may not be able to achieve your desired growth objectives within the projected time frame. It is equally crucial and challenging to consider your area’s current and potential competition.

- High tenant turnover

Typically, storage facilities offer rental units on a monthly basis. This means that tenants continuously move in and out of the units. The business needs a comprehensive self storage marketing strategy to maintain a high occupancy rate. Offering tenants lower monthly prices can also help maintain long-term contracts.

Self Storage Classes

Before researching how to invest in self storage, you must know the different classes self storage is classified into. The following are the three classes representing different self storage groups.

Class A

A class includes self storage facilities that have been newly built in the last 10-15 years. These facilities are in ideal locations with all the modern amenities, such as climate-controlled storage units, modern storage management software, and advanced security systems. Due to these amenities, such storage facilities have low turnover and high occupancy rates.

Class B

Storage facilities more than 15 years old are classified into B class. These facilities offer amenities and maintenance but are not as good as A-class facilities. They may lack round-the-clock maintenance and climate-smart features. The rental charges of such storage units are also average.

Class C

Older storage facilities that are not found in a prime location are known as C-class storage. They have low rental charges with limited amenities. The security measures may also not be up to the mark.

As an investor, you must consider the features and amenities offered by each facility class to make your investment decision.

How to Invest in Self Storage Businesses? 4 Popular Ways

If you wish to invest in the self storage market, here are four popular ways to do so. You can analyse each one of them closely to decide which one to choose.

Invest in Real Estate Investment Trust (REIT)

Another way is to invest in real estate investment trusts, commonly known as REITs. Self storage REITs own and manage self storage facilities and earn profits by renting storage spaces to individuals and businesses.

They are one of the best investments in self storage in terms of performance and return. You can start investing in REITs with low capital and become a passive investor.

Select a well-performing self storage REIT with good profitability projections and invest in it. You can earn a return the same way you would earn through stocks.

Self storage REITs earn income through multiple sources. This includes rental income, management fees, reinsurance income, and overdue fines.

Pros of Investing in Self Storage REITs

- Rising demand benefits REIT investors.

- High-profit margins and ROIs.

- The passive investment makes self storage operations hands-off for you.

- You can get started with a small capital investment.

Risks of Investing in Self Storage REITs

- The risk of oversupply and high competition exists.

- As a passive investor, you have no control over business operations.

Buy a Self Storage Facility

If you have enough funds, consider buying a self storage facility. It involves buying an existing income stream by paying a fair market value. You do not have to do the initial work, and you can start earning right after closing the deal.

For a beginner, buying an existing storage facility is better than building it from scratch. Experts suggest buying existing facilities and adding value to them before operating your business. This way, you can charge high rental rates and earn profit.

As your business grows and the facility starts making a profit, you can earn a significant return on your investment.

3 Steps to Buying Storage Units

- Exploring financing options: Look into financing options like traditional mortgages, commercial loans, or partnering with investors. Determine the best approach based on your financial situation and long-term investment goals.

- Due diligence: Perform a thorough due diligence process, including property inspection, reviewing financial records, and assessing legal aspects. Engage professionals like real estate agents, appraisers, and attorneys to ensure a smooth transaction.

- Property management: Before exploring storage units for sale, decide whether you will manage them yourself or hire a professional property management company. Effective management is crucial for maintaining high occupancy rates and maximising returns.

Pros of Buying a Self Storage

- It is a hands-on investment, and you have complete control over business operations.

- You are in charge of the management and decision-making.

- A faster time to market helps you reach breakeven quickly.

- All the profit you earn is yours, with no shareholder claims.

Risks of Buying a Self Storage

- Buying an existing facility is more expensive than building one.

- The risk exists of misunderstanding or underestimating the repairs and maintenance needs.

- A lack of knowledge about market demand and customer needs may lead to buying the wrong self storage class.

- Security expenditures may be higher than you estimate.

3. Build a Self Storage Facility

Many active investors want to build a storage facility from scratch to obtain their desired objectives. Building a storage facility takes a lot of work and requires significant investment. You need extensive market research to choose the right location and find the ideal site.

After building, you need strong marketing to attract customers and offer high-quality services to retain them.

Pros of Building a Self Storage

- Building a storage facility can be cheaper than buying one.

- You can control all aspects of construction, layout, and design.

- You can build your desired unit mix.

- New facilities are more appealing to renters and can generate high rental income.

Risks of Building a Self Storage

-

The market risk is higher in building than in buying.

-

You need industry expertise and knowledge to avoid construction and design mistakes.

-

The building is time and labour-intensive.

-

It may take three to four years to reach 90% occupancy and realise your fair market value.

-

You must get your self storage marketing on point

4. Invest in a Self Storage Syndicate

Another way to invest in self storage is through self storage syndication. It refers to a group of investors who pool funds to invest in self storage collectively. All investors in the syndication agreement are passive investors and considered limited partners in the deal.

The management and operations of the projects are led by the sponsor of the syndicate. The investors benefit from the profit and take their respective shares in it. You can become a passive investor in a self storage syndication if you are an accredited or sophisticated investor.

Choose a reputable syndication company and apply for membership as a passive investor in a self storage syndication.

Pros of Investing in Self Storage Syndicate

- Real estate investing syndicate in self storage offers higher returns than a self storage REIT.

- Investing in a group reduces individual risk.

- It offers tax advantages to passive investors.

Risks of Investing in Self Storage Syndicate

- A self storage syndicate project lacks liquidity.

- The investor’s share of funding commits for the duration of the investment lifetime. They only get it back when the project concludes.

- REI syndications lack due diligence increasing the risk of fraud.

- Lacks control over business operations.

5 Things to Consider Before Investing in Self Storage

Investing in self storage syndicates, stocks, or REITs does not involve any input from the investors except the funding. However, building or buying a storage facility is an active investment.

These self storage investment approaches require a lot of research and analysis to generate a good return on investment. When you choose to invest in building or buying a self storage facility, it’s advised you look into these 5 aspects:

- Market research

- Financial analysis

- Choosing the right location

- Knowing your customers

- Mitigating the risks

1. Market Research

Conduct thorough market research to identify areas with high demand and limited supply of storage units. Analyse population growth, local economic factors, and competition to ensure a favourable investment climate.

2. Financial Analysis

Evaluate the financial aspects of investing in storage units. Consider purchase price, operating expenses, rental rates, and potential return on investment. It’s essential to work with a financial advisor or real estate professional to assess the economic viability of the investment.

3. Choosing the Right Location

Location is one of the major deciding factors in how successful a self storage business will be. For self storage investments, choose a location with a considerable population, commercial activity, or residential developments, and avoid basing your decision on projections. Prioritise locations that offer convenience and accessibility to potential customers. Additionally, consider storage unit features such as security systems, climate control options, and unit sizes to cater to diverse customer needs.

4. Knowing Your Customers

Understanding your target customers and knowing their habits is important to cater to their needs. As an investor, you must know the consumer habits of your target market to allocate your resources thoughtfully.

The major target customer groups for self storage are residential, commercial, students and military personnel.

-

Residential customers usually need medium-sized storage units to keep furniture and other belongings during downsizing and home moving. They rent a storage unit for around 6 and 13 months.

-

Commercial customers are small and medium-sized businesses that rent a unit to store their inventory. They usually need a medium to large storage space for 2-4 months.

-

Students rent storage space during holidays, academic breaks, or internships. They prefer renting a unit near their campus for 3-4 months. If you plan on offering storage options to students, seek storage units for sale that can rent for pocket-friendly rates.

-

Military personnel need storage facilities near their military bases. They rent out storage space during their deployment that can continue for six or more months.

5. Mitigating the Risks

To earn maximum return on your investment in self storage, you need to control risk factors as much as possible. Prior planning and market research can help you minimise certain risks and maximise your ROI.

-

The first concern for you must be how often storage units get broken into in your target location. If the rate is high, you need to take some extra security measures. Ensure that there is adequate oversight at the storage facility.

-

Instead of trying to reduce costs, invest in amenities and repairs that can increase the rental charges. For instance, good lighting, advanced management software, and a modern lock system.

-

Target secondary or tertiary locations to avoid the risk of oversaturation. Primary locations are usually overcrowded with large operators.

Are Storage Units a Good Investment for 2026?

When looking to invest in self storage, the first question that may cross your mind is, “Is owning a self storage unit business profitable?” The profitability of the business determines if it is worth the investment. Here is the quick answer.

Yes, self storage is a good investment for 2026 and beyond. With more people opting for downsizing and the trend of work-from-home surging, the self storage market is on a growth kick. There are multiple ways you can invest in self storage choosing between active and passive investment options.

Is Self Storage Investing Right for you?

Self storage investment is different from other forms of real estate investments. Despite its growing popularity, positive growth trend, and resilience against recession, self storage investing is not for everyone.

Knowing how to invest in self storage is not enough when making the investment decision. There are many reasons to invest in this industry and many others for not making this decision.

You must define your storage unit investment objectives clearly and thoroughly analyse the self storage opportunities and risks. Consider the long-term impact; it will help you make the right decision.

How to Invest in Storage Units: Bottom Line

Self storage is here to stay — the positive growth trends, along with efficient self storage management software and advanced security systems, make it a lucrative investment opportunity. However, ensure you’re well prepared to enter this competitive market by seeking professional guidance — this will help you gather information and make better self storage investment decisions.

To guarantee a successful investment, understand the market dynamics, conduct thorough research, and follow a diligent purchasing process. Remember to consult with professionals and stay updated on industry trends to capitalise on the potential of self storage investments

Frequently Asked Questions

Is There a Self Storage ETF?

Yes, there is a self storage ETF. Global Storage Inc. is a popular self storage REIT ETF. The company has a successful business model with a high dividend yield and reliable performance.

Is Self Storage Profitable?

Yes, self storage is a profitable business. The profitability of each self storage business varies due to several internal and external factors. The average profit margin in this industry is 41%.

What Are the Risks in Self Storage?

Some common risks in the self storage industry are:

- Theft

- Fire

- Environmental damage (rain, humidity)

- Continuous tenant turnover

- Break-ins

Who Is the Largest Self Storage Company?

Public Storage is the largest self storage company in the US. The company owns around 2,787 locations all around the world. It offers more than 142 million square feet of storage space with 12 different storage unit sizes.

What Is the Profit Margin for Self Storage?

Typically, the profit margin for self storage business is 41%. It may vary from business to business depending on various factors such as the location, size, pricing, and amenities offered by the business.

How Do I Buy Stock in Public Storage?

To buy stock in Public Storage, you must follow these steps:

- Choose an online brokerage. * Open your account.

- Add your details.

- Select your payment method.

- Purchase Public Storage shares.

Is the Self Storage Market Growing?

Yes, the self storage market is growing. The Wall Street Journal called it recession-resistant due to steady growth irrespective of economic slowdown. As more people switch to hybrid or remote working, the self storage market will continue booming.

Is Starting a Storage Business a Good Idea?

Yes, starting a storage business is a good idea. It is a good source of steady passive income with low maintenance required. The success rate for a self storage business ranges between 90% and 92%, which is pretty high.

Is Self Storage a Passive Business Income?

Yes, self storage businesses generate passive income. This business has low risks and performs well even during economic downturns. The main source of income from a self storage business is the net rental income after deducting the mortgage (if any).